Over the past few months I have been working on a mortgage reduction system.

I’ve called this “Eat My Mortgage” and it’s an online mortgage reduction system that helps you structure your mortgage and show you how to pay your mortgage off faster

What is it, and why should you be interested?

Hello, my name is Stuart Wills and I’m the creator of the Eat My Mortgage concept.

I’ve spent over 20-years as a mortgage adviser and the concept was born out of the work that I have done helping people pay their home loans off faster.

I know that there are some mortgage repayment programmes that cost thousands of dollars and I wanted to create something so affordable and easy to use that anyone with a mortgage can benefit from.

Through this programme you will learn how to structure and manage your loans with your existing bank.

It may seem so logical once you get started that you will wonder why the bank hadn’t shown you this already, but then the banks are not really that keen to save you money are they?

But this Eat My Mortgage programme goes beyond just showing you how to set up your loans.

Over the weeks, months and years ahead you will be able to measure how much more quickly you are paying off your loans and how much you are saving.

You will also be given more tips and challenges plus you will be rewarded as you go.

I’m excited to see that you are ready to take the first step.

Paying off your mortgage faster can be extremely satisfying and will set you up financially for a brighter future.

What is the cost?

There is a small cost of $46 per month to join.

We believe is very good value when the benefits are considered and compared to the other mortgage reduction systems which cost a lump-sum of about $5,000.

Of course, you will be the judge of this and you can cancel your membership at any time if you feel that you are not getting value, or once you have paid your mortgage off.

An added benefit

How often do you recommend something to other people?

Most of us do this often (I know I recommend all sorts of things) and never get rewarded for it except maybe the odd “thank you” and we’re happy enough with that.

Well when I created the Eat My Mortgage concept, I wanted to make sure that people got to hear about it and so set about creating a referral programme that rewards you for recommending it.

It’s another little way that we can say thank you and you get paid so that you can put more into paying off your mortgage faster.

I thought this might just be a little bonus, but some users have been so happy to recommend the Eat My Mortgage concept that they are earning enough each month to make a significant difference!

The way it works is that users of Eat My Mortgage are encouraged to recommend this product to others, and for this they will receive a 20% of monthly commission so they can actually earn money from promoting this system. That’s $8 per member that signs up so as you can see it does not take much to have your own membership paid for, and from then you are making extra that can go towards paying your mortgage off faster.

Will show you

✅ How to structure your loans

✅ How to pay your loans off faster

✅ How much you are saving

Will give you

✅ Regular reminders and tips

✅ Challenges and rewards along the way

✅ Access to professional support

✅ All for a low monthly cost

What it provides

Regular reminders and tips – the key to the success of any mortgage repayment programme is to make small changes over time. It’s why we have named this programme Eat My Mortgage as the only way you can envisage eating an elephant is one bite at a time.

This is why the programme provides regular challenges, reminders and tips.

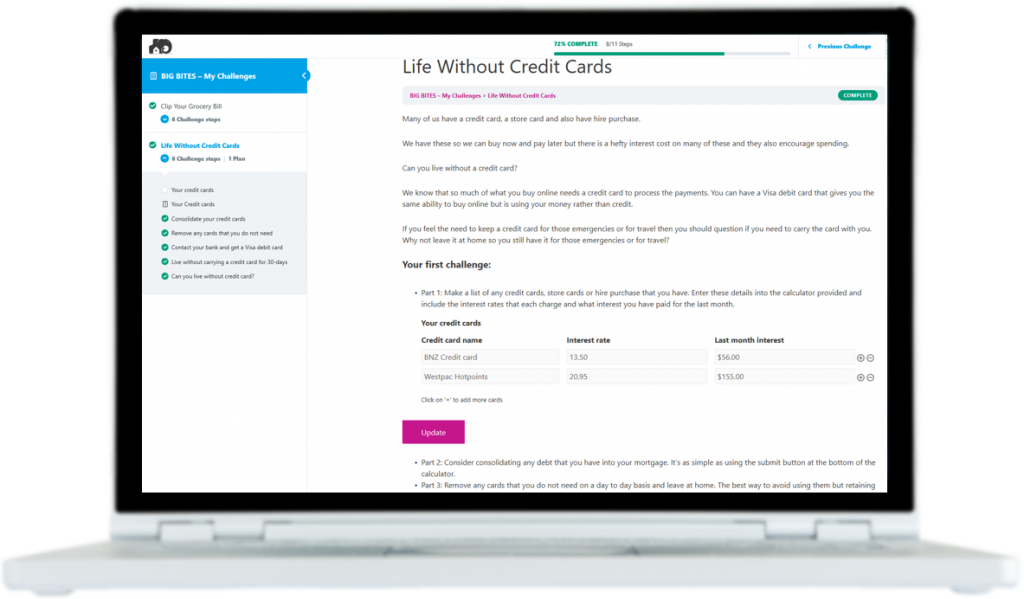

It has challenges for them to complete – there are regular challenges to be completed that can help you save money and therefore pay your loans off faster.

It gives you access to professional support – you always have free access to professional help if needed.

What it shows

How to structure your loans – the concept is you do not have to change banks.

Often you are told that you need to refinance your mortgage, but the Eat My Mortgage programme works with most banks so we say use your own bank and then just restructure your lending to the recommended structure.

Of course, you may choose to change banks and you can do this if you want.

You will be encouraged to have a mortgage broker do this for you as they provide this service at no charge to you and can ensure that you are offered competitive interest rates.

We are building a network of brokers throughout the country or we have online brokers too.

How to pay your loans off faster – This is ongoing, and you will be encouraged to make small changes over time to pay your loans off faster.

One bite at a time…

How much you are saving – of course the major success of this programme is the savings that you are making.

When you login you can monitor how much more quickly you are paying off your mortgage and also how much you are saving.